Overview

Industry

FinTech

Region

Canada

Duration

12 Weeks

Node.js

Node.js Dialogflow CX

Dialogflow CX Python

Python MongoDB

MongoDB Redux

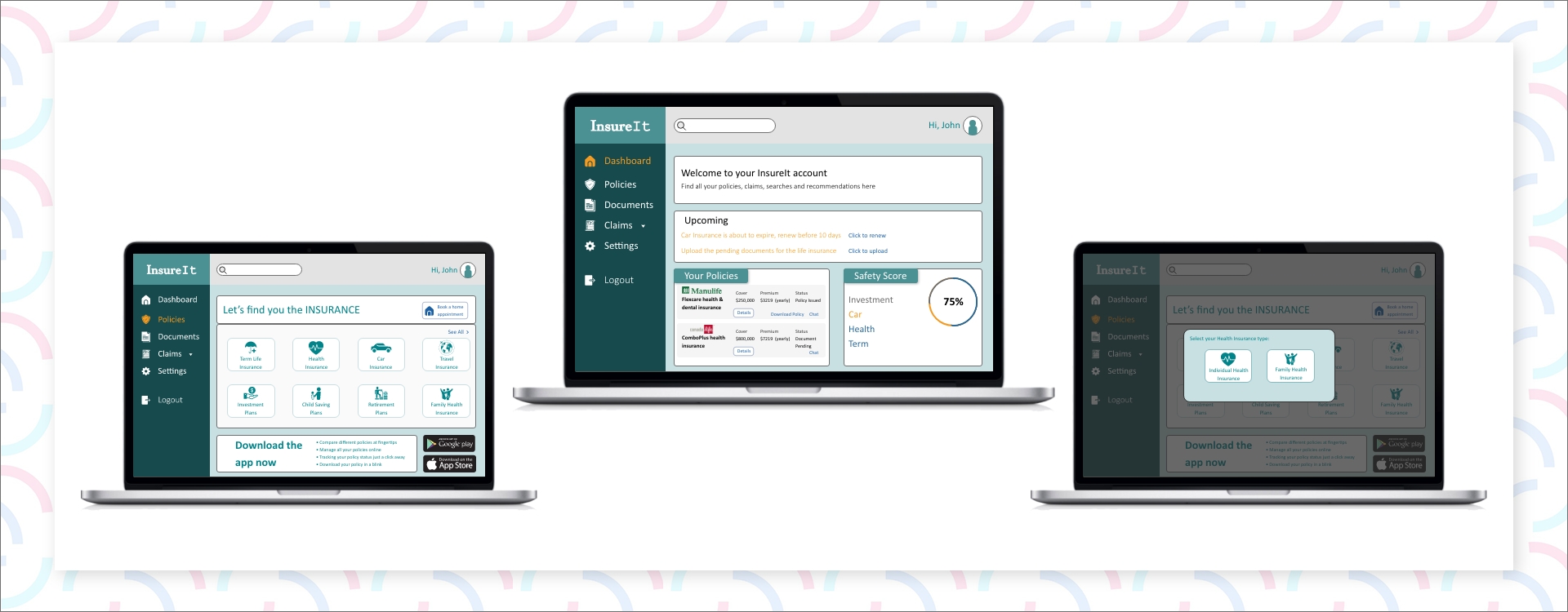

ReduxThe client is a Canada-based SaaS company leading the transformation of online insurance purchasing. Their goal is to simplify the process of comparing, selecting, and securing insurance policies through a seamless digital experience powered by an advanced online insurance platform.

The insurance market operates on a largely closed architecture, making it extremely difficult for customers to compare policies from different providers. The client identified several key obstacles:

To address these challenges, we built a smart SaaS insurance platform with advanced digital capabilities that positioned the product as a digital insurance marketplace and an insurance comparison platform:

The platform delivered significant improvements across user engagement and business performance:

Let’s transform your idea into a real product with scalable solutions.