Overview

Industry

Blockchain as a Service (BaaS)

Region

USA

Duration

16 Weeks

Node.js

Node.js MySQL

MySQL AWS

AWS iOS

iOS Blockchain

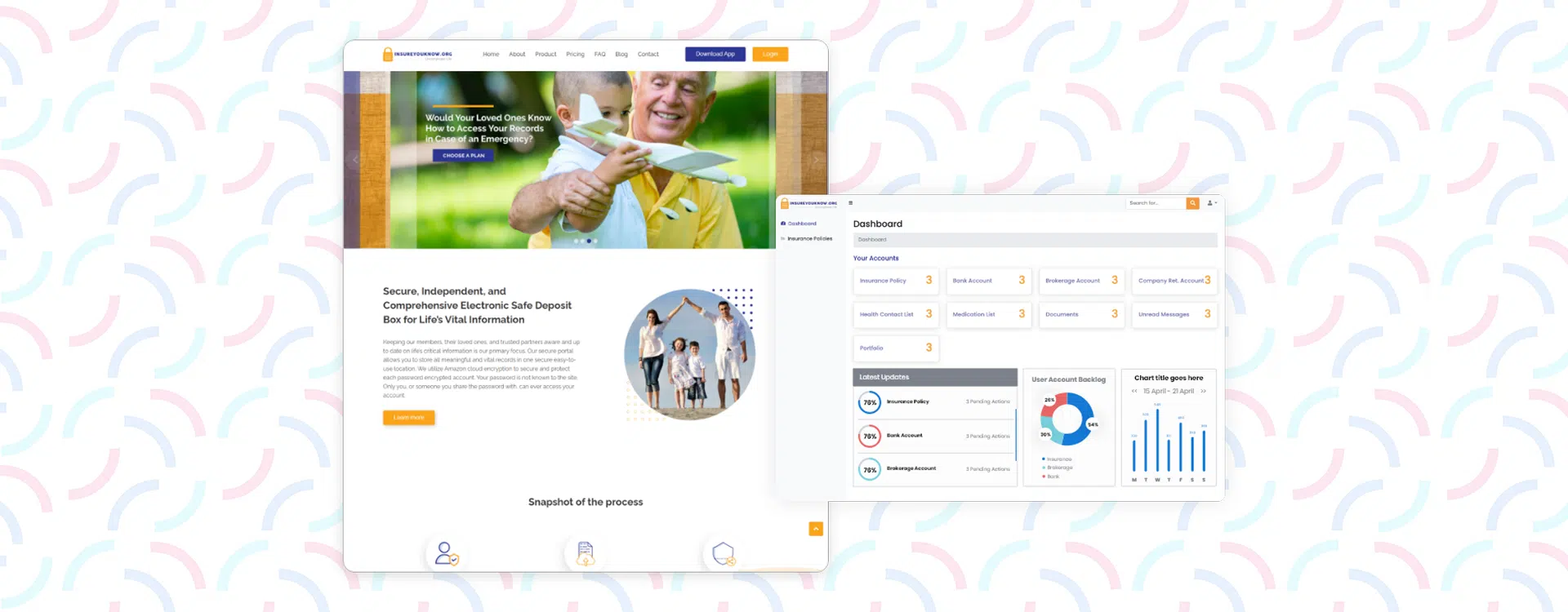

BlockchainThe client is one of the largest InsurTech companies, located in Austin, Texas, that works closely with the best insurance companies in order to provide a secure environment where you can consolidate, manage, and access all of your insurance-related information through a unified digital platform. The initiative represents a significant step forward in leveraging blockchain in insurance to improve data protection and user trust, further positioning the solution as a next-generation InsurTech platform.

Let’s transform your idea into a real product with scalable solutions.