Overview

Industry

FinTech

Region

Australia

Duration

12 Weeks

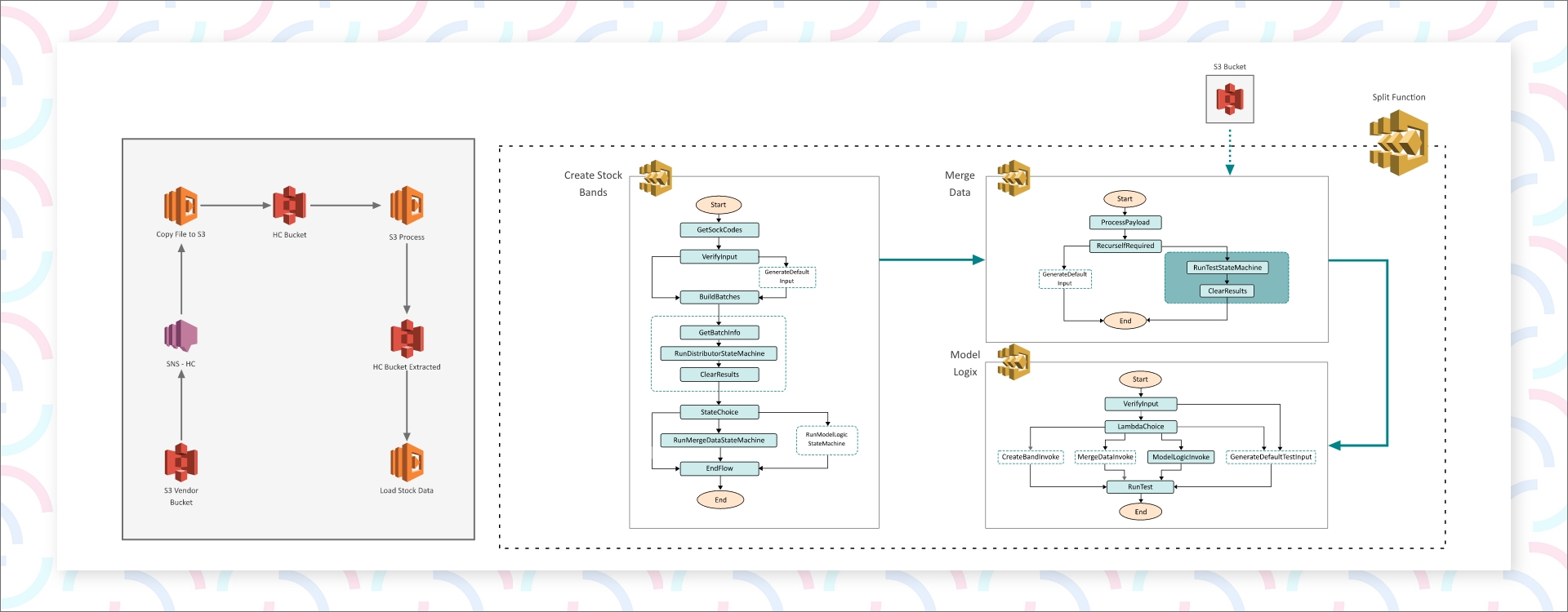

AWS Lambda

AWS Lambda AWS S3

AWS S3 PostgreSQL

PostgreSQL AWS RDS

AWS RDS AWS SageMaker

AWS SageMaker AWS Step Functions

AWS Step Functions AWS SNS

AWS SNSThe client is an Australia-based stock market investing and consulting firm with a strong presence across Australia and New Zealand. Expanding their reach, they are now entering the US stock market with an innovative machine learning (ML) powered stock price prediction product, strengthening their capabilities as a modern stock analysis platform.

The client faced the following challenges:

Seaflux implemented a comprehensive solution that included:

Let’s transform your idea into a real product with scalable solutions.