Overview

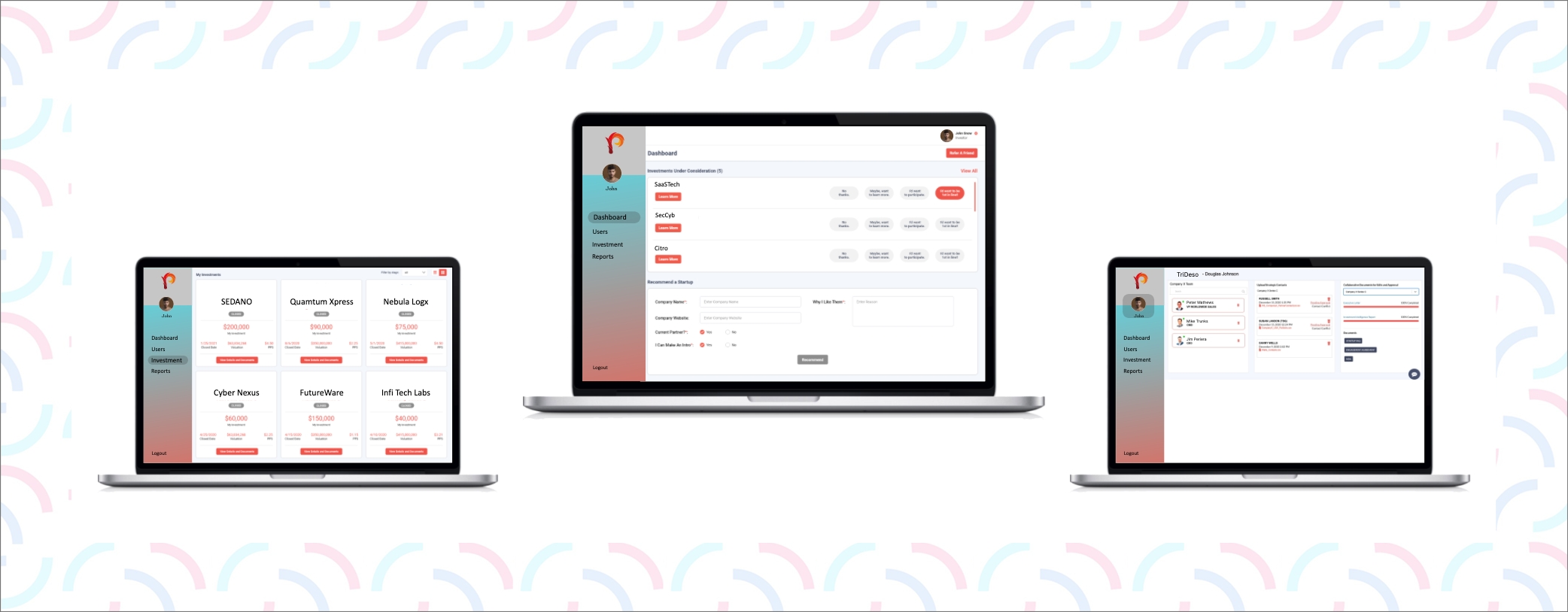

A collaborating web platform hosted on AWS for investors and startups seeking pre-IPO investment opportunities to scale up their business.

At A Glance

Industry

FinTech

Region

USA

Duration

1 Year

Technical Stack

Client Profile

The Client is a SaaS provider based out of Los Angeles, providing venture capital solutions since 2015.

Challenge

- Our client relied on a conventional documentation system to oversee investments and the requisite paperwork, that required physical visits to the startup firms for the onboarding process.

- The client had to assign an individual to onboard the startups and prepare Pitch Decks that had to be presented to the investor. The client wanted an automated system that could take care of the pitch decks based on the data provided by the startup firm while onboarding virtually.

- The client wanted a unified & secure platform capable of storing documentation of the startups and investors and having information such as board members, leaders, and key customers in a centralized location.

- The client sought an automated procedure for handling exit processes for the startups, enabling investors to easily track their profits from startup investments.

- The client used to face problems in managing multiple investments being done by the same startup as the process had to start over for onboarding.

Solution

- Seaflux developed a web platform hosted on AWS that centralizes investor and startup management, matching the startups with the best fit strategic investor using data science, enhancing efficiency and effectiveness for the client.

- The solution automatically generates investment details, including invested amounts, profits, losses, disbursement amounts, and applicable fees for each individual investor.

- Simplifying the onboarding process for startups, the platform utilizes Investment Intelligence Reports (IIR). Instead of creating PowerPoint presentations for Pitch Decks, startups can now fill out details in a step-by-step form while onboarding, allowing the platform to automatically generate a professional Pitch Deck.

- The platform streamlined the client's management of multiple investments by establishing a hassle-free onboarding process that only needs to be completed once and carries over to future investments.

- The platform compiles and presents investment performance data in the Summary section, offering insights into how each investment is performing.

- Role-based access on the platform grants specific features and permissions to each user role. Startups can manage their details, investors can access and navigate their investments and Exit Process, while administrators have comprehensive control over all investments and investors.

- Integration with DocuSign enables the creation of necessary documents for each investor promptly upon opting for an investment. Investors digitally sign these documents, which are securely stored on DocuSign for easy verification by administrators.

- The investors can easily track their investments from their dashboard instead of continuously calling/emailing the client for the details.

Key Benefits

- Since the onboarding process was replaced with the IIR, the onboarding time reduced by 47%.

- Since the calculation of the profit/loss and disbursement is automated, the miscalculation was reduced by 40%.

Develop your next idea with usGet in touch