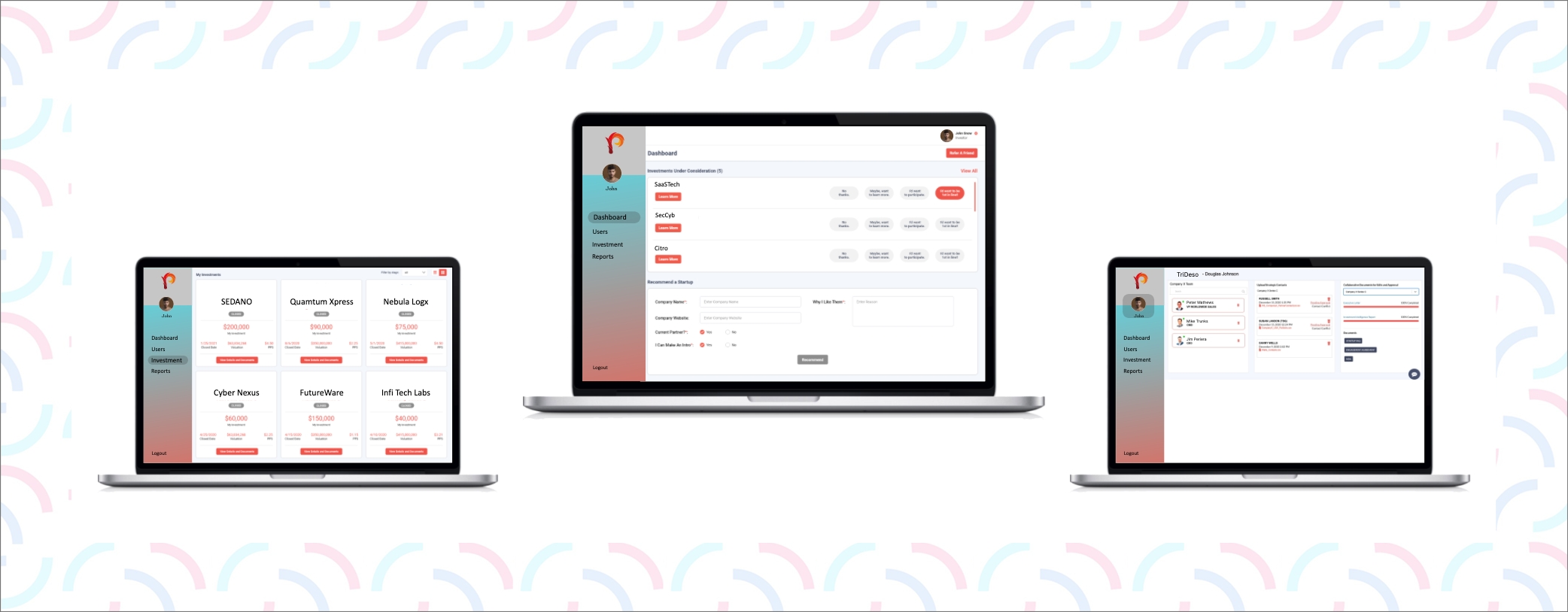

A fintech SaaS venture capital solution with a pre-IPO investment platform, investor dashboard, investment automation, and performance tracking for startups.

Overview

Industry

FinTech

Region

USA

Duration

1 Year

Node.js

Node.js ReactJS

ReactJS AWS S3

AWS S3 MongoDB

MongoDB AWS EC2

AWS EC2 Amazon CloudFront

Amazon CloudFront AWS Route 53

AWS Route 53 AWS ECS

AWS ECS DocuSign

DocuSign AWS WAF

AWS WAFThe Client is a Los Angeles-based fintech SaaS firm that provides a venture capital solution. The firm has worked with investors and startup firms since 2015 to expedite startup funding and investment. Over the years, the client developed strong relationships with several venture capitalists and entrepreneurs, but wanted an updated digital solution to satisfy the increasing complexities of the investor process and startup funding.

The client was heavily dependent on a conventional documentation system to oversee investments and maintain all necessary paperwork. This outdated method created multiple operational hurdles:

In short, the client was looking for a scalable, secure, and automated VC management platform to address these issues in order to service both investors and startups more effectively, including automated investment management and investment automation to streamline processes.

Seaflux designed and developed a web-based fintech SaaS VC management platform hosted on AWS to meet the client’s needs. This solution streamlined startup–investor interactions, eliminated redundancies, and introduced automation to key business processes.

Key features of the solution included:

Let’s transform your idea into a real product with scalable solutions.