Overview

Industry

Food & Beverages

Region

Europe

Duration

12 Weeks

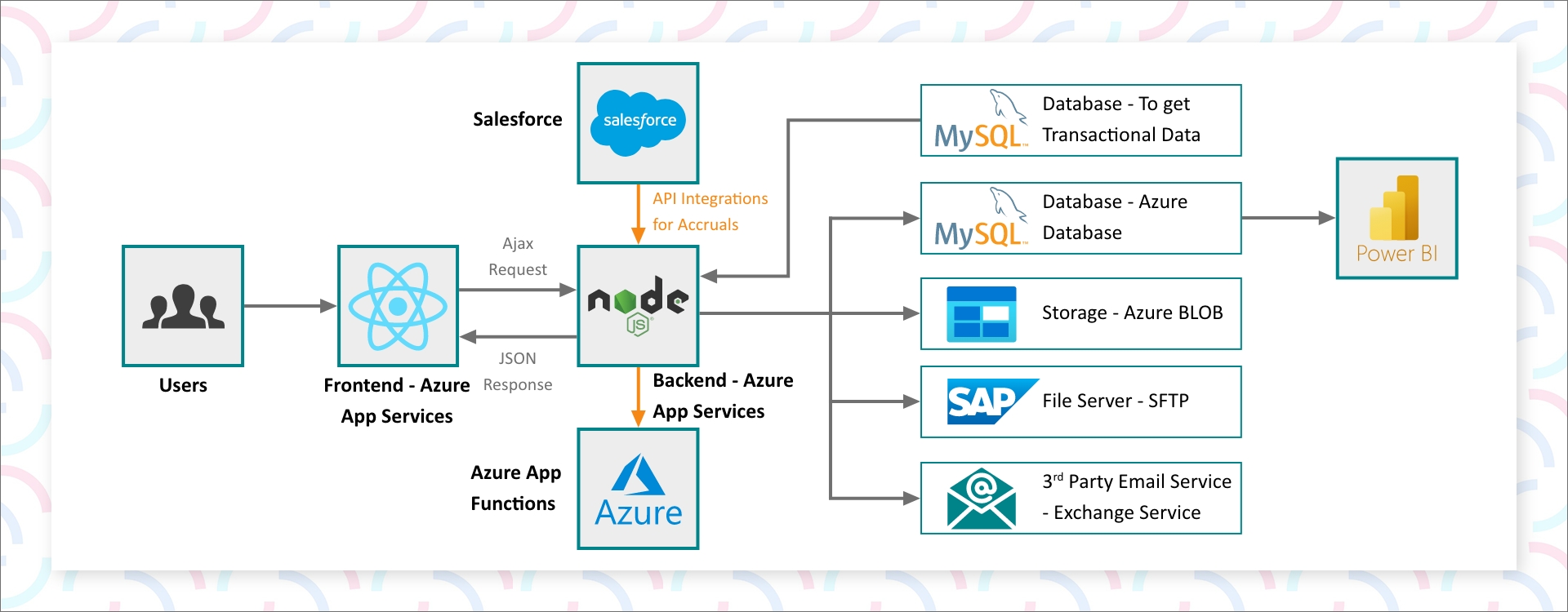

Power BI

Power BI Azure Blob Storage

Azure Blob Storage Microsoft Azure Active Directory

Microsoft Azure Active Directory Microsoft Azure SQL Database

Microsoft Azure SQL Database BlackLine

BlackLine Microsoft Exchange

Microsoft Exchange Salesforce

SalesforceThe client is a prominent brewing company in Europe that operates a powerful system of more than 300 breweries. Their regional distribution system allows them to address more than 1 billion consumers and 3 million customers worldwide.

Let’s transform your idea into a real product with scalable solutions.