FinTech

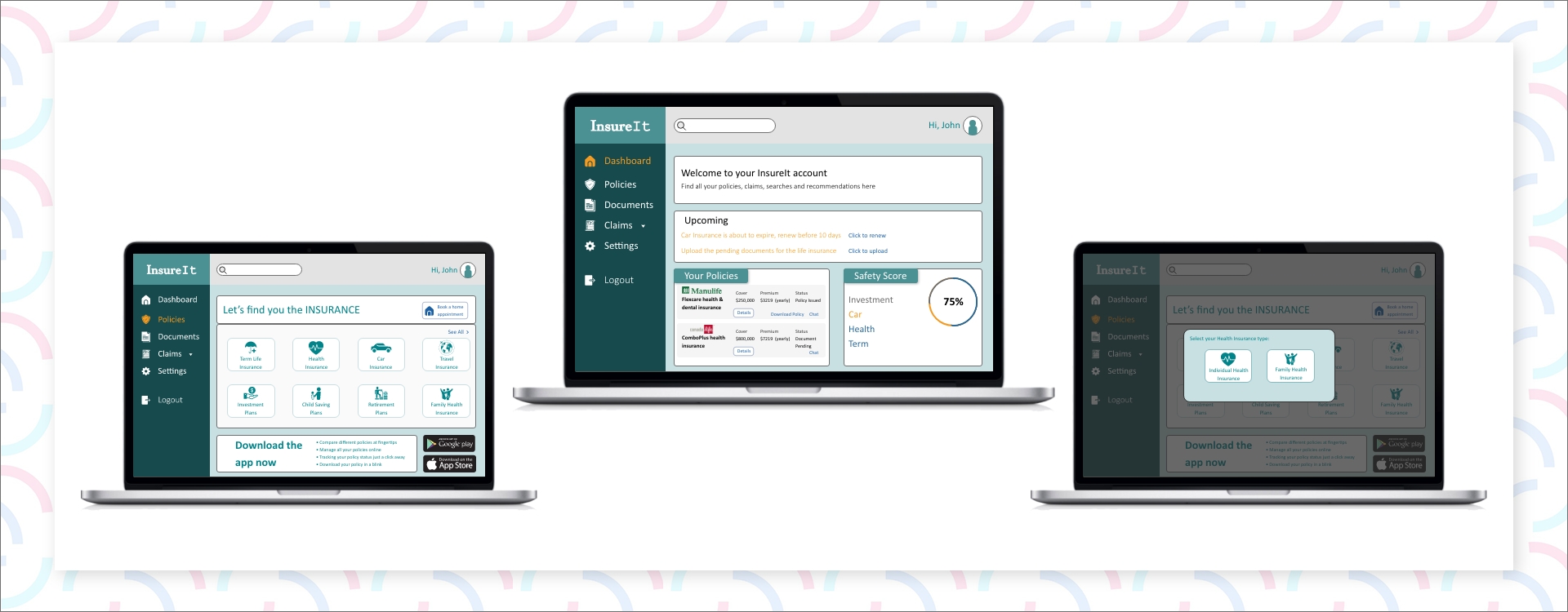

A smart platform that enables businesses to purchase insurance policies online with ease and security.

Client Profile

The client is a SaaS company based out of Canada, paving the frontier for the online purchase of insurance policies.

Challenge

- Comparing different policies from various providers seems impossible due to the closed architecture.

- There was a strong need for a mediator in insurance policies. Convincing prospects to buy insurance, and suggesting the most suitable policy for them was a task to be accomplished in the online medium.

- The offline insurance process is quite time-consuming, which the client wanted to reduce by eliminating all the intermediaries. These intermediaries also tend to increase the premium price that would ultimately cost the buyer.

Solution

- We provided a platform where detailed comparisons of different policies can be done based on their premiums, service quality, and features, which eventually assisted buyers with the purchase. The platform has eliminated the manual, time-consuming paper-driven processes by digitizing them.

- The platform also segments its entire customer data according to their lifestyle to recommend them better policies according to their need while catering to inflation simultaneously.

- Whenever an insurance request was processed, an automatically generated PDF confirmation was sent to the customer.

- To provide more customization, a chatbot was used on the platform to make customized and instant replies to their queries or even provide insurance quotes based on customer requirements.

- MongoDB database was used to store the data, which is further used to train the ML model to provide better policy recommendations according to the entire customer journey.

- Whenever a user visits the page multiple times, data is loaded from the Redux stored in the user’s browser cache, instead of calling API every single time, which loads the page faster.

Key Benefits

- There was a 27% increase in the business from the online medium. Inbound lead queries saw a massive surge.

- With the use of a chatbot, response time was reduced from 25-30 seconds to instant replies, increasing customer satisfaction.

- Instant PDF confirmation gave the buyers security & trustability of the policy purchase.

Used technologies

Develop your next idea with usGet in touch